.png)

Instant Payments for Enhanced Business Strategy

Introduction

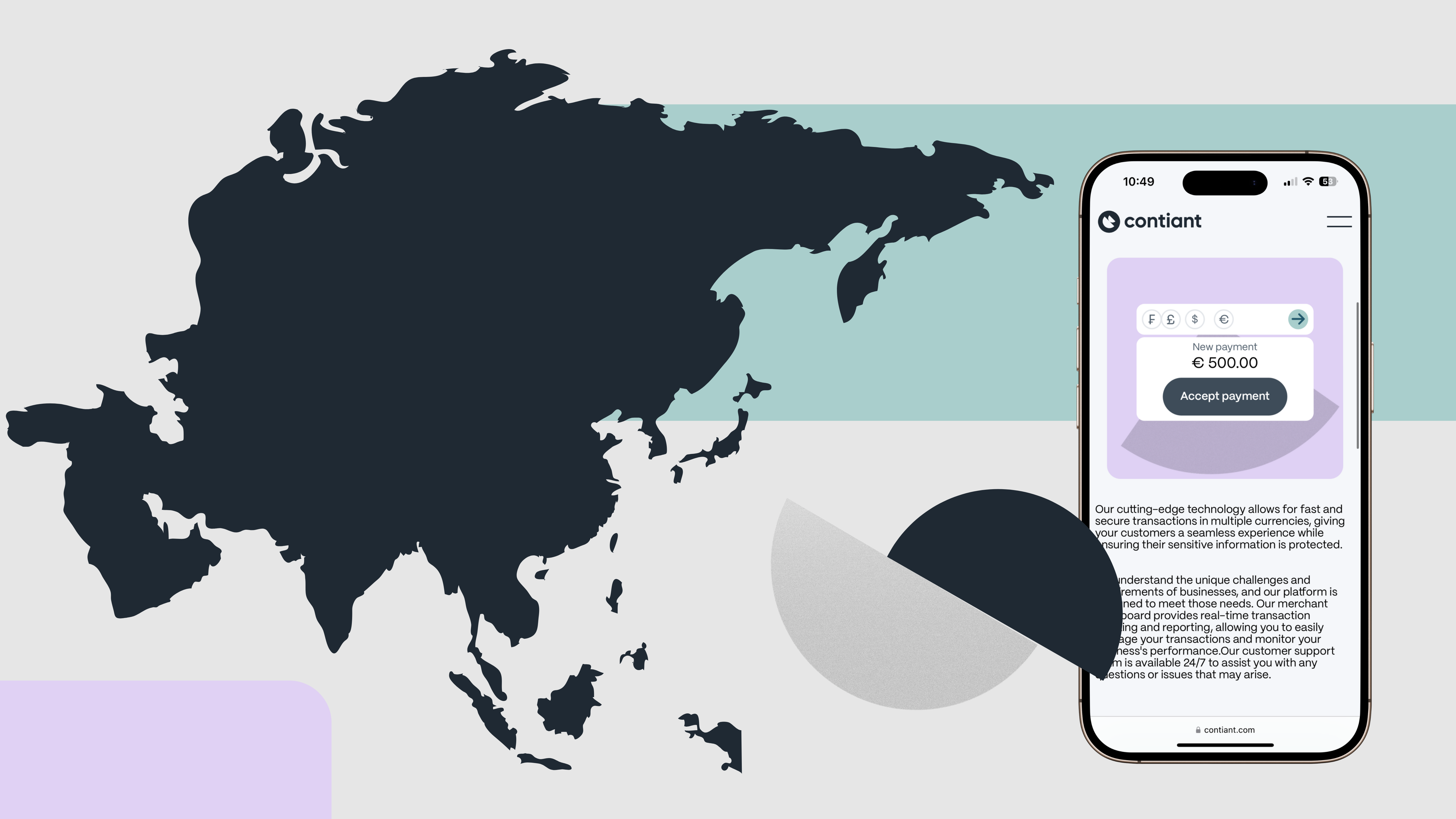

The emergence of account-to-account payment systems is the embodiment of transformative innovation in the ever evolving landscape of finance and business. It’s not only about facilitating transactions, account to account payments are totally reshaping the business landscape by offering robust tools for strategic decision making wich lead to greater customer insight and sustainable growth.

The Evolution of Account to Account Payments

Account to account payment systems have exceeded their initial objective, improving the fluidity and speed of financial transactions between different accounts. The conventional limits of traditional banking are being challenged by these mechanisms because they established an interconnected platform that concentrates a huge range of financial services to provide seamless operations.

The Collaborative Power of Account to Account Payments

The ethicality of account-to-account payments is based on collaboration, creating an environment where banks , fintech companies and financial service providers come together, thus forming the basis of an efficient financial ecosystem.

The goal is not only to speed up transactions, in this case, but also to find new ways of planning strategies for expansion and diversification of the same business

Strategic Benefits Offered by Account to Account Payment Solutions

Data-driven insights

The load of data that account-to-account payments provide represents an invaluable asset.By analyzing this data, they provide crucial insights into consumer behavior, based also on market trends.This information subsequently becomes the guide for making certain business decisions.

Innovative Product Development

Capitalization of services, and from certain information derived from account-to-account payments opens the way for certain innovative financial solutions. These innovations can generate new revenue streams, thus also going to meet certain needs of specific market niches.

Tailored Customer Experiences

Account-to-account payments allow for hyper-personalized service; this kind of personalization makes the customer satisfied with the service, and in turn goes a long way toward consolidating and building customer loyalty to the brand.

Streamlined Compliance and Risk Mitigation

Through what are the standardized structures that account-to-account payment systems guide the customer in his or her transaction while avoiding incurring risks of error of the last.

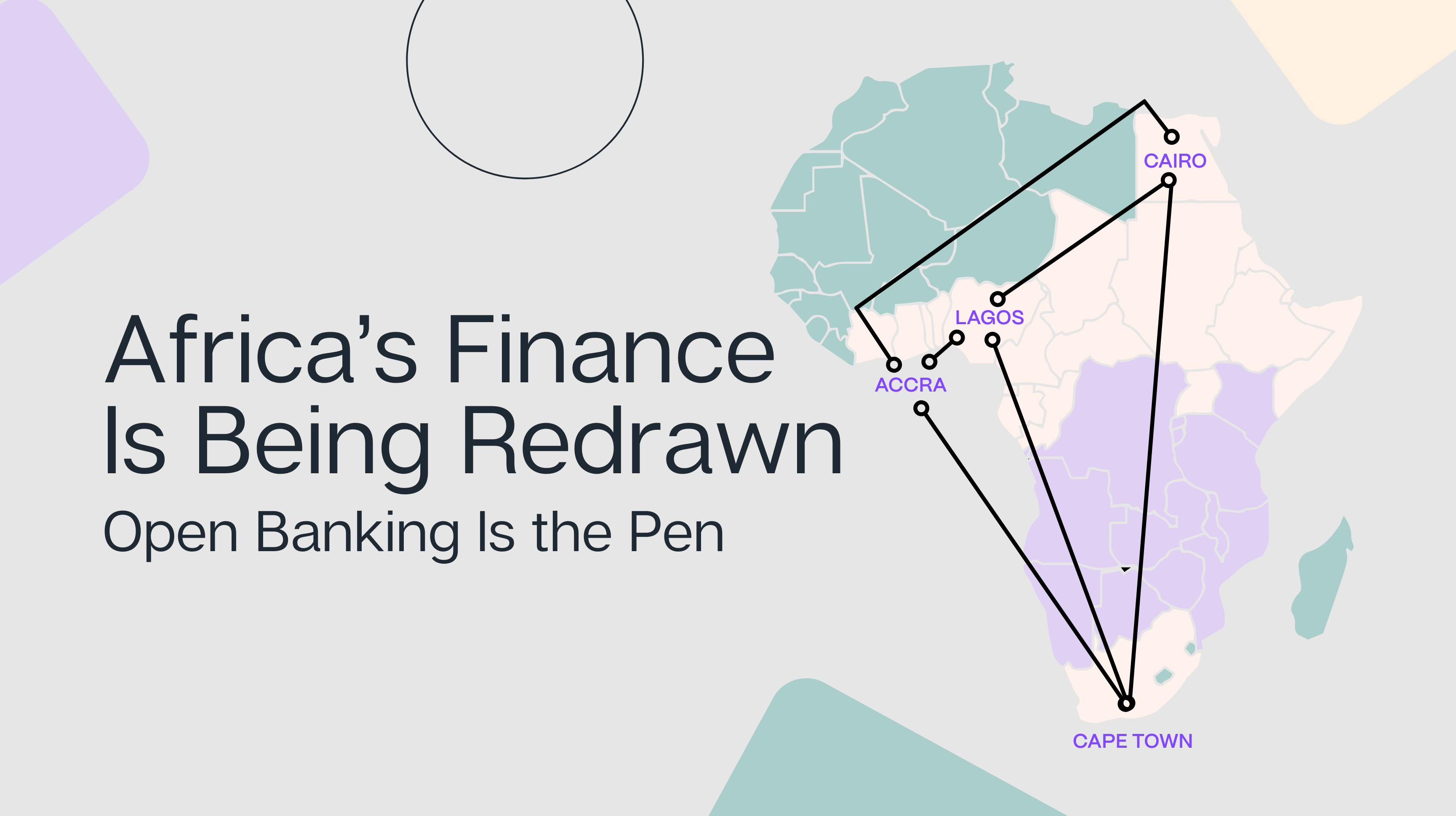

Facilitating Global Ambitions

The inherent compatibility and flexibility of account-to-account payments simplifies cross-border financial activities, allowing companies to position themselves favorably for international expansion.

The Broader Implications for Modern Business

The financial strategies of diverse industries like e-commerce platforms, digital start-ups and brick-and-mortar establishments are getting reshaped by account to account payments solutions. Reducing the overhead costs allows these systems to augment their operational efficiency thus offering precise transaction tracking and better transparency. To ensure their longevity and prosper growth in a perpetual competitive market, businesses have to have an overview of their economic health. That’s where these payment systems step-in in to act like a perfect strategic tool for companies.

Conclusion

More than just a leap in financial technology, account to account payment systems underline a tremendous shift in business strategies. These systems are quickly becoming a turning point for modern businesses because of their unparalleled access to data and emphasis on collaboration. Their role and influence will amplify to cement their status as a keystone for modern successful companies.

.jpg)

.png)